I haven’t written much about hotel loyalty programs here at The High Life, mostly because the topic isn’t anywhere near as popular with readers as airline reward programs (which makes sense as the latter are much more accessible), but also because I haven’t personally relied on hotel loyalty programs much when travelling.

Whenever I’ve looked at using points for hotel stays in the past – mainly by transferring American Express Membership Rewards points to the Hilton or Starwood programs – the deal never seemed as good as transferring those points to an airline for business or first class fares instead.

Plus, I’ve tended to avoid large hotel chains, preferring to stay in smaller boutique hotels or Airbnbs – so hotel points hacking and/or getting elite status hasn’t been a priority.

That being said, travel is all about new experiences, and lately I’ve been feeling the urge to try luxury hotels more. I think this has been partly sparked by experiencing elite hotel status perks recently thanks to my new American Express Platinum Card, and also because it’s a new frontier in travel for me – plus, I’m getting older, so my accommodation tastes are getting more expensive!

So, over the past few months, I’ve been looking into hotel loyalty programs more, trying to work out where the best deals and hacks are.

Unfortunately, the opportunities to get the kind of epic value I’m used to with airline points are rarely there with hotels. It’s just a function of how hotel loyalty programs work.

Nevertheless, there are some solid opportunities to be enjoyed, and I have a few tips lined up to share with readers in future posts.

Today, though, I want to cover an especially good opportunity that’s just popped up and which is causing a lot of excitement among points hackers.

As you may have heard, a mega merger is taking place right now with the Marriott, Starwood and Ritz-Carlton hotel groups. The new entity has over 6,500 hotels worldwide across an eye-popping 29 different brands. It’s massive!

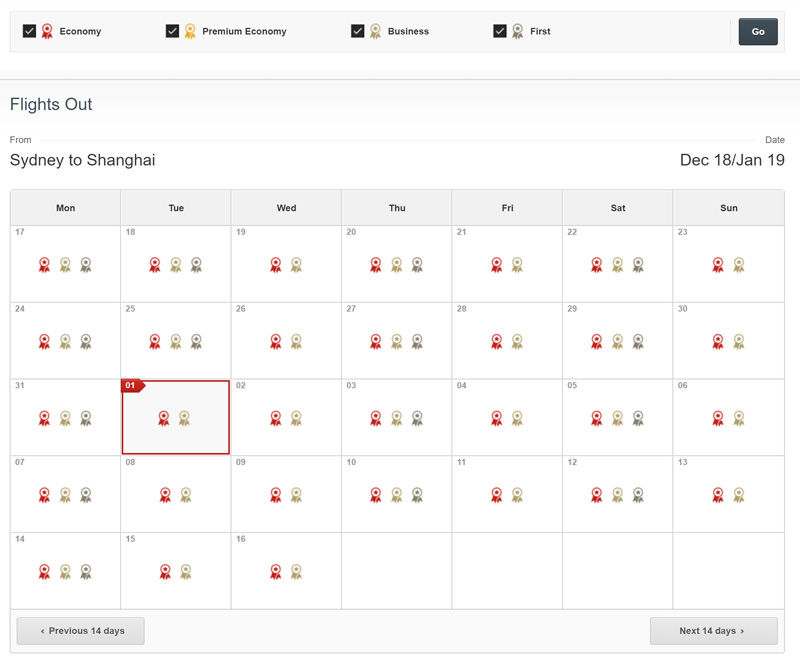

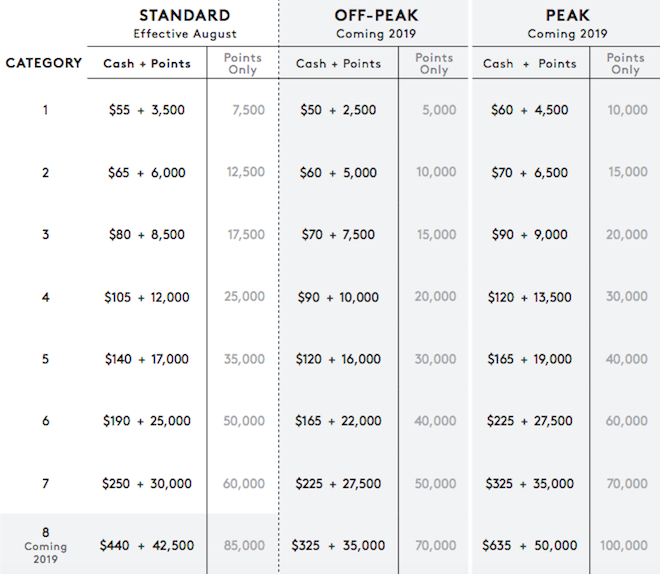

Marriott has been steadily releasing details about its new unified loyalty program, which launches on 1 August. Here’s the new award chart for stays using points (the “points” don’t have a name yet – that’s coming in 2019).

As you can see, from August until the end of the year, a night’s stay will be priced according to the “Standard” columns above, but from 2019, the price will depend on whether the stay is during the peak or off-peak season (the dates for these haven’t been released yet).

In addition, the most expensive Category 8 properties will be priced at the lower Category 7 level for bookings made this year, even if the actual stays are in 2019.

We also finally learned a few days ago the category that each hotel will fall into.

So, here’s where the opportunity lies: Category 8 will include properties that have historically been very expensive to book using points. This includes ultra-luxurious hotels and resorts, including all-suite properties, in exotic locations like the Maldives and Bora Bora, which can cost thousands of dollars per night.

Booking these properties later this year means enjoying savings of up to 40% compared to current prices, and of course, you’ll also save in comparison to the 2019 prices.

You can stack this with Marriott’s “fifth night free” deal, where you get a complimentary night for an award stay of 4+ nights.

So, for bookings made from August until the end of the year, you’ll need 240,000 points to get 5 nights’ accommodation in any Category 8 property, the full list of which you can view here (sort the table by the “New award category” column).

If you have lots of SPG or Marriott points, or if you can acquire them (eg. by transferring Amex Membership Rewards Points to SPG), this is an excellent opportunity.

SPG points transfer to Marriott at a 1:3 ratio.

If you are transferring Amex Membership Rewards points, you’ll get a better deal if you do so this month, because the new Amex -> Marriott transfer rate will not be as good as the current Amex -> SPG -> Marriott transfer rate from August (we’ll have an article about this published later this week).

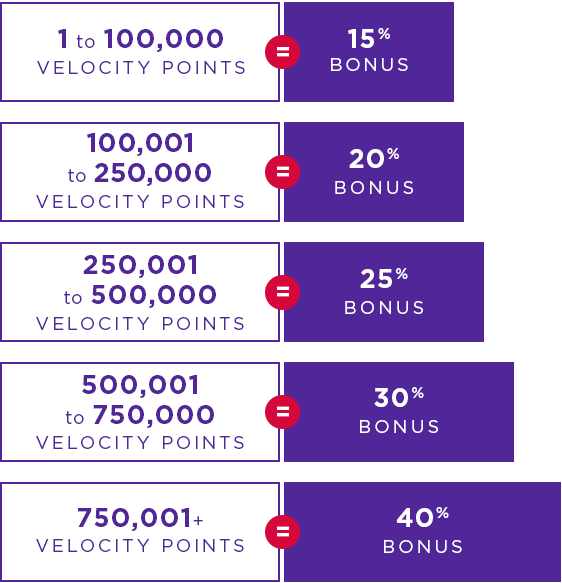

You can also purchase SPG points right now at a 35% discount. This offer ends on 20 July and you must have been an SPG member for 14 days to take advantage of it. Buying the maximum 30,000 SPG points costs ~AUD$950, and this converts to 90,000 Marriott points in the new scheme.

Here’s how I’m taking advantage of this opportunity.

As I have ZERO Marriott or SPG points right now, I’ve just purchased 30,000 SPG points (= 90,000 new points) and transferred 100,000 Amex Membership Rewards points from my Amex Explorer Credit Card to SPG (= 50,000 SPG points = 150,000 new points), giving me the 240,000 points I need to make a five-night booking.

The properties I’m eyeing off are for a planned trip to New York, one being the St Regis (which costs about US$1,000 per night) and the other the Ritz Carlton (which costs US$1,200 per night).

If I was paying cash, I’d have to fork out US$5000-6000 for this stay, which is about AU$6,800-$8,200! Instead, I’ve paid AU$950 for the SPG points plus Í’ll use 100,000 of my Amex Membership Rewards Points.

I consider this to be a bargain!

I’m also looking at some of the more distinctive Category 8 properties, like the Al Maha desert resort in Dubai, for a truly memorable hotel experience.

To get tips like this delivered straight to your inbox, subscribe to our newsletter: